Every year, the period from May to July sees grain markets enter the most volatile time of the season.

Domestically, planted acres will be in the ground and internationally, the northern hemisphere weather risk period will be in full swing. So, which one is the main price driver, and which one should we keep a closer eye on?

International

In April this year both North and South America experienced adverse dry weather which created concern for production in these regions and drove prices higher. The reason this dry weather caused so much panic around the world is the largest agricultural futures market sits in Chicago and its prices, to a large extent, rely on the crop production of these regions (specifically soybean, corn and wheat). When North and South American crop production is impacted, global supply is also impacted, so price typically rallies and the whole world watches and reacts.

Therefore, a price rise in Chicago agricultural futures will typically create a rally for grain and oilseed prices around the world.

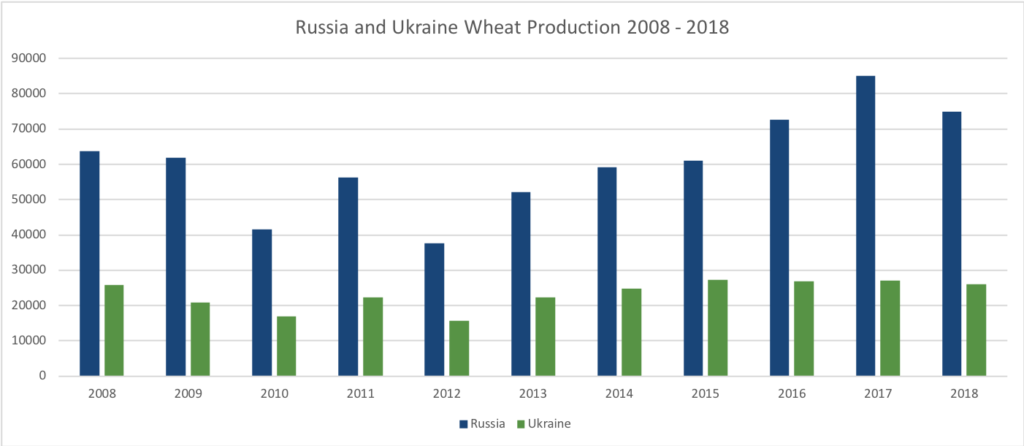

At the time of writing this report both Russia and Ukraine are experiencing fantastic growing conditions for wheat. Russia and Ukraine have been expanding their agricultural output over the last five years with better technology and crop management. This has led to these nations becoming a major competitor into our traditional exports homes of Asia, pushing Australian prices down during their harvest. Typically, Russia and Ukraine harvest their crops in June, but due to their wetter than average conditions, this harvest is expected to be slightly delayed allowing Australia to have a longer export window this year, keeping the export demand on our shores and supporting Australian prices.

This is all simple supply and demand, right?

Well, unfortunately international influences aren’t always that simple.

To make price influences even more confusing we need to focus on what the global economic and political outlook is to ensure we have not missed anything which may influence price in either direction. Most recently, there has been a political war played out between the US and Chinese governments over tariffs being place on certain products and commodities from each country. It started with the US placing tariffs on certain Chinese produced goods like solar panels, and at the time of writing, the Chinese Government retaliated by placing a 25% tariff on US commodities such as pork and corn. This created waves of volatility in markets, impacting the equities and commodities exchanges.

Domestic

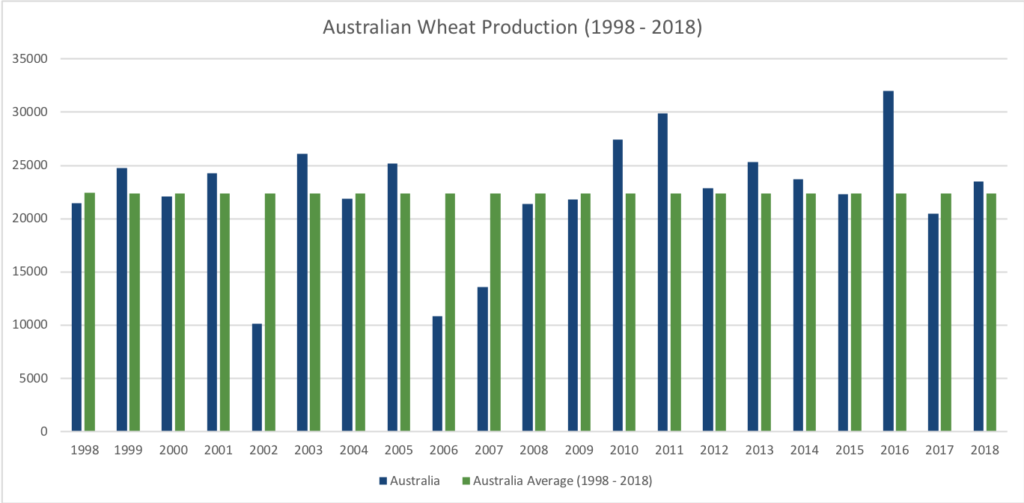

Last year, parts of Western Australia and most parts of Victoria produced good crops but unfortunately South Australia, NSW and Qld saw adverse growing conditions. The 20 year average wheat production in Australia is 22.28MT and as the chart below illustrates, Australia has very volatile growing seasons. Last year with the unfavourable growing conditions, wheat production was 20.5MMT which was below the 20 year average. This put a floor on wheat and barley prices at harvest time and caused a gradual rally in prices since harvest which rewarded growers who deferred their wheat and barley sales.

Unfortunately, the start of the planting window saw dry and hot weather and this created concerns of a negative impact on acres planted. The dry weather pushed Australian grain values higher in April due to what is known as a ‘weather market’ where growers, consumers and traders alike become worried a certain weather event will have a significant impact on production. Growers continue to hold a small amount of grain as a hedge against future production, and traders and consumers bid higher and higher to fill their demand.

The key growing period in Australia is August and September where rainfall is needed to create grain filling, and typically the industry will have a good handle on what to expect from harvest in early October. It is vital to keep a close eye on the weather and rainfall to date and also the frost risk to have a good handle on production and quality levels, as these also have a significant impact on grain prices.

What is outlook and what should we focus on?

The catch in broadacre farming and commodity marketing is the influences tend to lie out of our hands. We never know 100% what the government or the weather will do day-to-day, so coming to a ‘definitive conclusion’ of what will happen to grain prices is nearly impossible. Domestically, when grain markets trade into a ‘weather market’ it is easy to focus solely at home because the longer it doesn’t rain, or the longer the frost window lasts, the more likely we are to see large spikes in grain values. But, it is important you don’t overlook what is happening globally, such as the weather risk period in the northern hemisphere or developments in the political environment between major trade partner nations such as China, Indonesia and Japan.

So, to answer the initial question of, ‘which influencer should we watch?’ the answer is both. We live in a global economy therefore we can no longer only worry about what is happening in our own backyard but need to pay attention to what is happening around the world. Any influencer, be it the size of the Black Sea crop, the weather taking a turn for the worse in North America, a drop of rain in outback Australia or Governments decreasing or increasing tariffs, could have a dramatic impact on grain prices both domestically and internationally.

Agfarm is a diversified agribusiness focused on grower and consumer services. Agfarm has a national footprint with staff throughout the Australian grain belt, providing a wide range of services backed by accurate market intelligence, experience and price discovery. For more information on how Agfarm can assist your business, call 1300 243 276 or visit agfarm.com.au

Report produced 17th April 2018.