Year on year auction volumes were up by 2.4% in 2017- 2018 while AWTA core test volumes were up by 1% (farm bales). Superficially these small changes in total greasy wool supply indicate that supply is unlikely to be a significant factor in the current market.

Apparel wool has a wide range of end uses of varying value, which is why processors do not buy whole clips and simply tip them into the scouring bowl. Wool of varying quality is purchased for different uses according to suitability, price and availability. For white combing length merino wool, the dominant wool quality is fibre diameter, which has the greatest influence on price. The influence of fibre diameter on price fluctuates, with changes in supply being the major influence in this fluctuation.

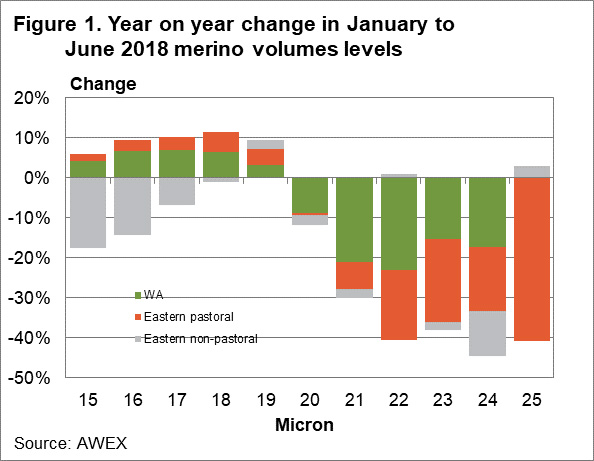

In the current market, supply is playing a big role in the relative prices for different micron categories. Figure 1 shows the change in sales volume of merino combing wool for the January to June 2018 period compared to year- earlier levels. The change in volume for each micron category is broken up by region (Western Australia, eastern pastoral and eastern non-pastoral). The drop in the volume of broad merino wool (broader than the average 19 micron) stands out with 21 micron volumes down by 30% for the second half of last season and 22 micron plus by 40%. These are big changes in volume which are not reflected at all in the change in total volume which is often the quoted number in press reports. When it comes to supply microns ain’t microns.

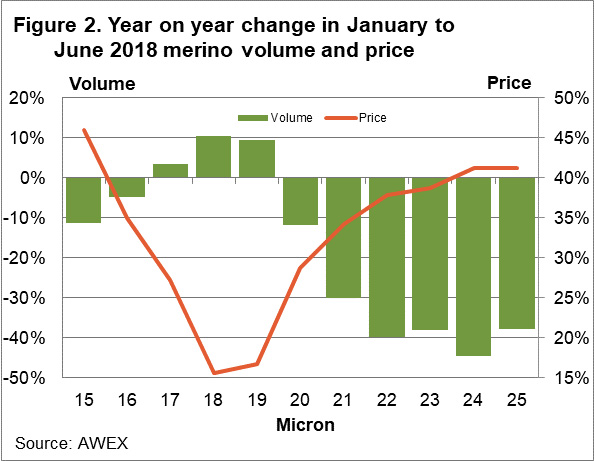

Figure 2 compares the change in the volume shown in Figure 1 with the change in the average price per micron category for the same period (January to June compared to the same period a year earlier). The 17 to 19 micron categories are the only ones recording an increase in volume during the past six months. The 19 micron category is the main category by volume in the merino clip, so we will use it as the reference point. 19 micron volumes were up by 10% and the average 19 MPG was 17% higher, which is an excellent result (higher volumes and higher price).

Now, in Figure 2 look at the change in price for 21-24 micron. For these categories, price is up by 34% to 41%, a big price rise. However, part of this price rise has been bought by a much lower supply. If the base price rise indicated by the 19 micron category is 17%, then the extra 17% gain in the 21 micron price is probably due to the big drop in supply. This is a crude analysis but it indicates around half of the 21 micron price rise is due to lower supply, and supply accounts for even more of the 22-25 micron price rises. In Figure 2 a simple regression analysis indicates that around 59% of the change in price is due to the change in supply.

What does this mean?

The great thing about merino supply is that Australia has the biggest supply of it in the world and it is very well reported. This means we can track changes in supply very closely and use this information to understand the component of price movements due to supply, which helps remove some of the mystery from the market. The simple analysis in this article shows that around half of the rise in broad merino prices in 2018 looks to be due to the drop in supply, which in turn means this part of the price is susceptible to future increases in supply.

[key_points]Sources: AWEX, ICS

Mecardo is Australia’s leading agricultural commodity risk management advisors and market intelligence experts. Mecardo delivers the expertise of advisors and other market intelligence experts in a concise, easy-to-read format.

It doesn’t just report the market news – Mecardo explains what’s driving the market, helps to understand what’s important and what it means for the reader. The client base of Mecardo is spread across the agricultural landscape, including producers, processors and consumers of Australian agricultural commodities, both domestically and internationally.

For more information visit our website at www.mecardo.com.au, or contact us on ask@mecardo.com.au